Climate resilience for small businessesProtecting vital engines of growth from the worst effects of flooding

Atram’s AI-powered platform provides small business owners with an advanced early flood warning system and actionable steps to protect their businesses. Through financial service providers, we also provide emergency liquidity to aid preparation and recovery.

Not only are small businesses safeguarded, but financial service providers are able to build loyal customer bases.

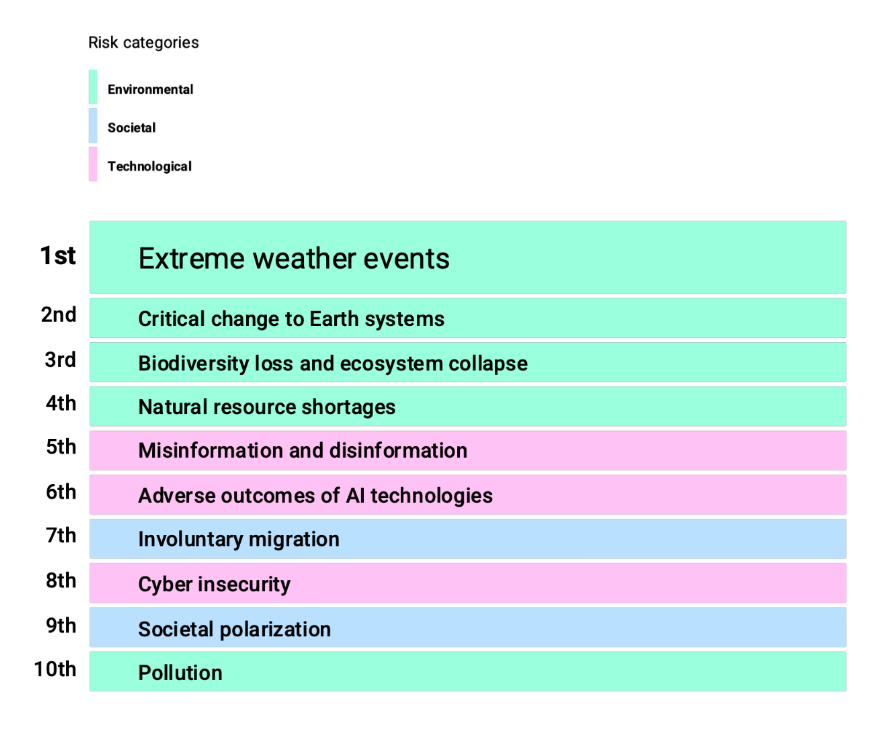

The small business resilience gap

In emerging economies, small businesses are the engines of growth, yet they are dangerously exposed to the escalating threat of climate change, especially flooding.

Limited access to finance

A lack of savings, credit, and insurance makes it nearly impossible for these businesses to absorb the shock of a flood, let alone invest in protective measures.

High physical vulnerability

Many SMBs who operate in high-risk flood zones have inadequate infrastructure, leaving their assets and livelihoods vulnerable to destruction.

Informality & lack of support

Operating informally often excludes these businesses from government aid and formal recovery programs, leaving them to fend for themselves when disaster strikes.

As these events become more frequent and severe, the risk of complete loss escalates. Without adequate support and resilience strategies, small businesses face the danger of being pushed out of the market entirely.

FSP challenges

In an era of increasing climate volatility, financial service providers face critical challenges.

Inadequate risk assessment

Traditional risk models often fail to capture the nuances of climate-related threats, leading to inaccurate pricing and unforeseen portfolio vulnerabilities.

Customer portfolio instability

When small business clients are hit by disasters, the impact cascades — resulting in loan defaults, reduced engagement, and a weakened portfolio for the FSP.

Eroding customer loyalty

Without proactive support for climate resilience, FSPs risk losing customers to competitors who offer solutions that protect and empower them in the face of uncertainty.

However, these are also significant opportunities for growth and market leadership. If financial service providers can actively support their customers to become more resilient in the face of such challenges, they will help generate customer loyalty and thereby strengthen their market position.

Our solution: A three-pillar approach to resilience

Our AI-powered platform helps small businesses minimize flood damage and accelerate recovery.

Early warnings you can act on

- Receive timely, clear alerts for impending climate events.

- Utilize the latest advances in AI-powered disaster forecasting.

- Minimize risks and avoid costly disruptions with actionable information.

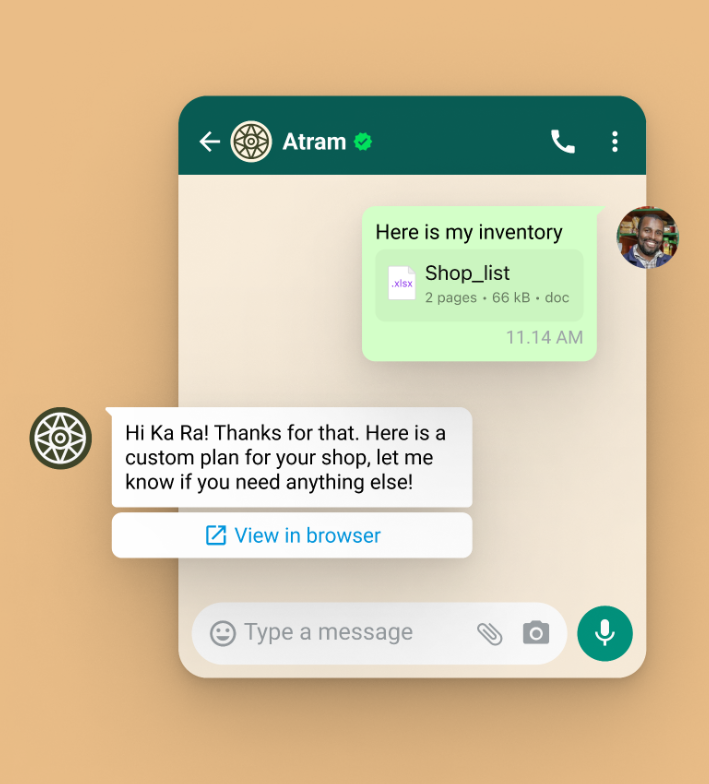

Customized preparation plans

- Get tailored plans for the unique needs of each small business.

- Follow clear, mapped-out steps to safeguard against disasters.

- Build and execute a proactive resilience strategy.

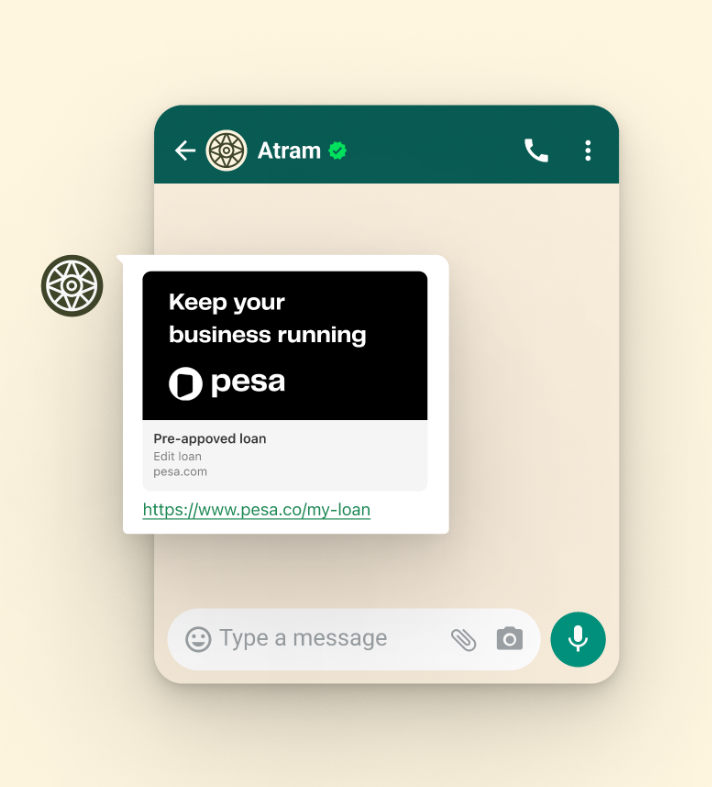

Emergency liquidity

- Ensure rapid access to funds when disaster strikes.

- Gain a financial safety net to support quick recovery.

- Strengthen customer trust and loyalty in your brand.

Why Atram

About us

At Atram, we believe that businesses can thrive despite climate challenges. Born out of the CIFAR Alliance and backed by FSD Africa, Atram combines cutting-edge AI, fintech innovation, and partnerships to create tools that protect lives and livelihoods before and after climate disasters strike.

Our mission is bold: to transform how small businesses prepare for, respond to, and recover from climate shocks. From forecasting disasters with precision to enabling access to emergency loans, we work with financial service providers, small businesses and their suppliers to ensure help reaches those who need it most—right when it's needed.

Atram, Inc is a Delaware C-Corp registered at 1178 Broadway, 3rd Floor 4278, New York NY 10001.

Our founder

David del Ser

CEO & Founder

- CIO at BFA Global

- Founding role at CIFAR Alliance

- Catalyst Fund (Climate Tech Fund)

- Frogtek (Shop Analytics)

- Leo Impact Fund

Our partners & supporters

Working with leading organizations to drive climate resilience globally

Get in touch

Let's build climate resilience together